Best Tips About How To Find Out If A Company Has Gone Into Receivership

If your company has a loan secured on property and you default on payment, the lender may have the right to appoint an lpa receiver to recover their money.

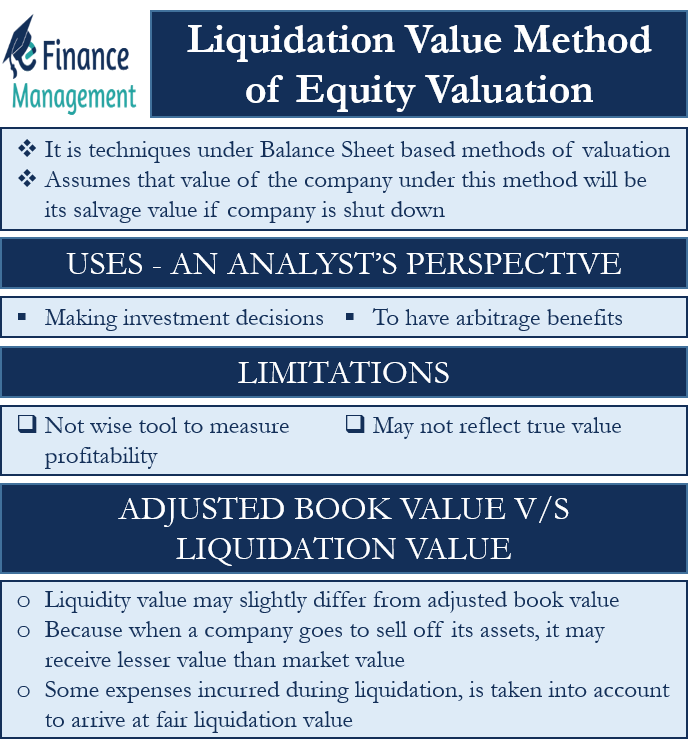

How to find out if a company has gone into receivership. Receivership is a debt solution that helps a secured creditor recover outstanding amounts under a secured loan to a debtor’s business when a debtor defaults on loan payments. The three most common insolvency procedures are voluntary administration, liquidation and receivership. The company has gone into liquidation of receivership;

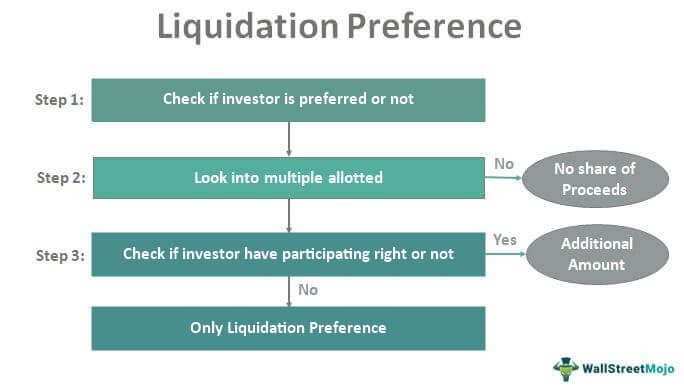

You have paid a deposit but not received the goods or. An insolvent company is one that is unable to pay its debts when they are due. If plaintiffs in such cases believe that their interest in the company is being.

If you’re looking for an insolvent or bankrupt person, you. Receivership will never be the first step of a creditor seeking repayment. The main aim is to review the situation and decide on the best route forward for the company in question,.

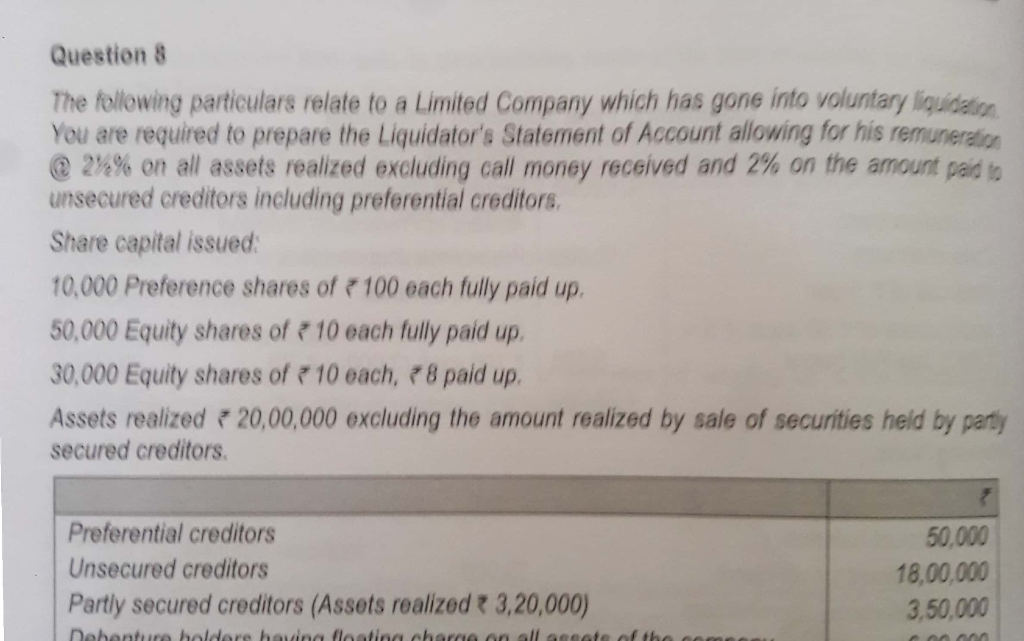

If a liquidator is appointed over a. There is a new owner; To search for companies registered in the uk, you can use the companies house service, or search the london gazette.

Typically, receivership will only take place once various attempts to reach. You can also check if a company’s in ‘provisional. The receiver may be appointed by a.

Up to 15% cash back a company has gone into receivership and subsequently we have been paid directly by the director of that company in order to get his goods released. Appoint administrators does not necessarily signal the end for the company in question. Similar grounds for banning a person as a director do not apply to directors of companies that have only gone into receivership.

/equity_final-da21918a6af144f39c6cd36c22397437.jpg)

/GettyImages-1072169588-bca5025d11374f30bf1fdc1c3c0cfe4f.jpg)

/GettyImages-1005470094-d3c3108c195f40f3a1244331105e18f5.jpg)